April 4, 2025, will go down in the financial annals as a day that Wall Streeters and Main Streeters alike hoped to forget. Abruptly punctuated by plummeting numbers, the once steady pulse of the stock market transformed into the jittery clatter of a patient on the brink of financial hypothermia. The Dow Jones Industrial Average took an astounding nosedive of over 2,200 points—an alarming 5.5% drop—while the S&P 500 and Nasdaq followed suit, each tumbling close to 6%. For those in the dampened mood of trading floors around the globe, the cause of this disturbance was clear: China’s audaciously fresh tariffs on U.S. goods sent ripples through the markets, like thick fog rolling ominously into a bustling harbor.

But as nerves frayed and market analysts scrambled to recalibrate their positions, the trading card industry—a niche that has surged into vibrant relevance and financial talking-point status over the past few years—sighed in collective trepidation. What would this Wall Street chaos mean for those whose portfolios were rich with rare and glossy pieces of cardboard holding the likenesses of sports icons?

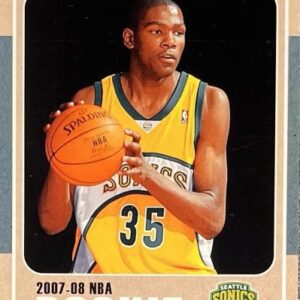

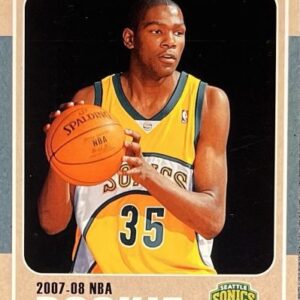

To understand the mood, one must appreciate the recent metamorphosis of the trading card industry. A pursuit once dismissed as a mere juvenile pastime, trading cards have re-embraced the spotlight, not just as wistful keepers of childhood nostalgia, but as viable and serious investment channels. In the foreground of this renaissance are celebrated athletes like Shohei Ohtani, Aaron Judge, and Mike Trout, whose cardboard avatars can command the kind of prices that make stockbrokers sit up a little straighter. Throw in a dash of rookie card allure, and suddenly, trading cards have metamorphosed into a stag’s antler of a portfolio—a prized and highly-coveted asset.

However, with the market turmoil comes a shadow of doubt over this fledgling boom. Economic downturns bring an undeniable tightening of belts, with discretionary spending—bread and butter for luxuries like trading cards—often taking a back seat to more immediate necessities. It stands to reason that with consumer confidence shaken like a polaroid picture fluttering in the wind, the demand for high-end cards might find itself reduced, potentially adjusting the market-bound trajectory of trading card values.

Yet, every coin has two sides, and market volatility sometimes acts as the springboard for investors to leap into the arms of unconventional assets. Tangible collectibles—trading cards included—can, under certain conditions, emerge as unlikely guardians of wealth. Historical data shows that rare memorabilia and sought-after cards have not only managed to hold their value during past economic slumps but have occasionally ascended.

The coming days promise a labyrinth of market choices for collectors and investors. With the right strategic gaze, an economic nosedive might transform into an unforeseen opportunity. As the winds of uncertainty blow, traders and collectors alike may find cards attractive, not just for their aesthetic or sentimental value, but as hedges against further market instability. The nuances of graded cards and the allure of limited editions could shine in a portfolio seeking solid ground among the shifting sands of economic conditions.

While Wall Street shakes off the haze of today’s financial thunderstorm, those entrenched in the trading card industry must brace for what could be either a drizzle or a deluge. They oar amidst a tempest of broader economic developments, oscillations in consumer confidence, and the ebbs and flows of market sentiment.

Will this downturn be merely a momentary blip in the radiant dash of the trading card saga? Or does it herald a more profound tectonic shift? This is the moment for collectors and investors to keep a hawk-eyed vigilance on unfolding indicators and to remain nimble, strategic captains at the helm of their collectible-filled vessels.

As events unfold, this industry, nestled at the intersection of nostalgia and finance, may well discover not only the endurance of its valuation but also unexpected avenues of prosperity. Wherever the story turns next, the intersection of stock market tumult and the trading card zeitgeist could provide a narrative full of surprise, resilience, and perhaps even a grand storytelling arc reminiscent of the legends immortalized on those cherished cards themselves.